Back to School: Teaching High School Students About Responsible Money Management

The teenage years are a rollercoaster of emotions. With the summer drawing to a close, the time to go back to school is fast approaching. As kids prepare for the upcoming school year, it’s important to talk to them about responsible money management, especially those in high school preparing for college. It’s never too early to start having conversations, and as a parent or guardian, it’s up to you to teach them about the value of money.

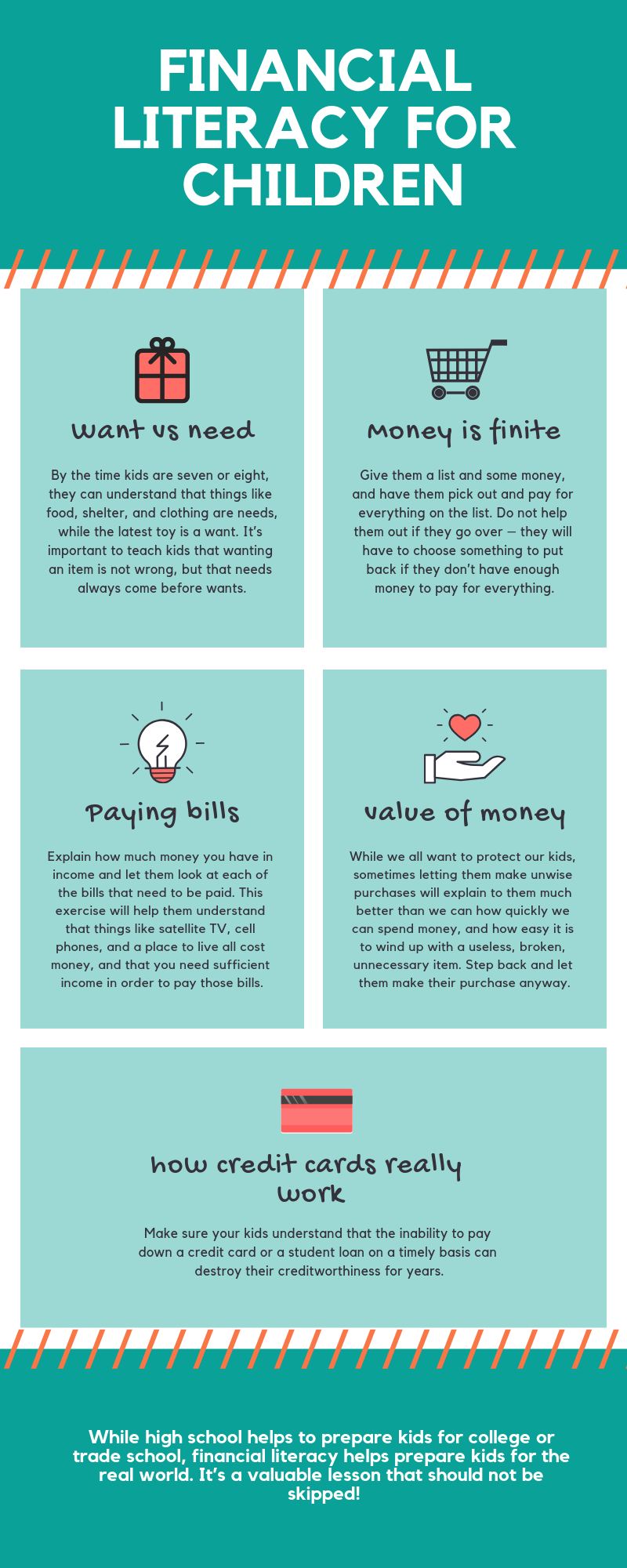

Today, we’ll be discussing important financial topics to speak to high school students about when it comes to college. We’ll cover topics such as wants versus needs, finances in college, and the value of money that comes with responsible money management.

Wants vs Needs

In high school, college seems like a distant dream. However, planning for college starts in these crucial years. Talk to kids about what they want in college. It’s essential to weigh out wants versus needs. When looking into colleges, have them create a list of things that they want in a school, and then have them create another list of what they need, such as educational programs, housing options, and inclusivity. Once that is created, discuss prices and see what schools make more sense financially. This is an excellent way to start having a conversation about budgeting and taking a critical look at finances.

Money is finite: Understanding the value of money is essential, and it’s essential to remind high school students that money is finite. Talk to them about the cost of SAT classes and how much college costs. By discussing prices, they can understand how to prioritize financial decisions. This can lead to informed choices about what exams to take and what extracurricular activities or academic programs they may want to pursue. It’ll be essential for them to understand that money cannot be frivolously spent, and a budget needs to be in place.

Paying bills in college

College life comes with many expenses such as tuition fees, textbooks, housing, transportation, and meals. Talk to your high school students about the importance of paying bills on time in college. Discuss how late payments may have negative consequences, such as late fees and added interest. Show them how to manage their finances by creating a budget and learn how to live within their means.

Value of Money:

The value of money is more than just its face value; it’s about understanding how money works. Speak to your high school students about your financial hiccups in high school and beyond. Your experience can help them understand the importance of putting aside money for future endeavors and being more responsible with finances. Teach them the value of compound interest and other essential concepts that can be hard to learn in school.

Listen to your child's thoughts about money

Lastly, it’s essential to listen to your child's thoughts on money. As they grow older and get closer to college, their opinion about money may change. Check-in with them regularly and see if there are any changes that need to be addressed or advice that needs to be shared. It’ll help them become more aware of their finances and how to manage them responsibly.

Ultimately, teaching high school students about responsible money management is essential for setting up a financial foundation for college and beyond. With an understanding of wants versus needs, the value of money, paying bills on time in college, and listening to their thoughts, your high school student will have at least had a money conversation with you as a core memory.

*This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal advice and may not be relied on for purposes of avoiding any Federal tax penalties. Individuals are encouraged to seek advice from their own tax or legal counsel. Individuals involved in the estate planning process should work with an estate planning team, including their own personal legal or tax counsel. Neither the information presented nor any opinion expressed constitutes a representation by us of a specific investment or the purchase or sale of any securities. Asset allocation and diversification do not ensure a profit or protect against loss in declining markets. This material was developed and produced by Advisor Websites to provide information on a topic that may be of interest. Copyright 2024 Advisor Websites.